There are some arguments that the LCOE of renewables are lower than gas and other energy sources. Other arguments are made that renewables ultimately will have a higher LCOE than the most efficient gas power plants. In this article, we will explore LCOE, how it applies to renewables, and some observations to the actions of energy majors. We will walk through analysis and comparison between the renewable 'bets' made by some majors in 2020 and 2021, finish. Ultimately we will review Orsted's journey to renewables player as a potential hope for a successful transition.

LCOE: What's it for?

Chiefly, LCOE is a critical measure to evaluate the cost of generation between different energy sources. It can show how much the cost of energy is from a specific asset type, configuration, etc. out into the future. This can help a utility select between investments in gas, nuclear, solar PV or wind.

Once it is determined whether a particular type of energy asset is viable, LCOE can be used to further refine and determine whether a specific project design can be viable from a break-even perspective. A key component of LCOE is the uptime and availability of the asset to generate power.

If the asset has a high up time and is generating for a high proportion of the time, we can say that the energy cost to uptime ratio is low. This asset can be considered reliable, operating with low time commitment to maintenance, reducing interruptions in generation. It could also be that the asset can successfully sell all of the power at requested price. If the asset has downtime around 50% of the time, we can consider that it has a high ratio of cost of energy to uptime. This can be because the asset requires maintenance, or that the cost of energy from that asset is high at that time (like overnight when power demand is lower so it is cheaper - a challenge for expensive power assets) - so the asset is shut off - not generating power. Even to plain eyes - it can be seen that an under-utilised asset is a lower value asset.

When I speak about value - I mean in the traditional definition:

Value = Happiness.

This may seem a wishy-washy definition but it is accepted at business schools such as Harvard as a reasonable measure. And this is because it is intuitive: think back to the last time you were disappointed at the price of some good or service. You had a certain expectation of what you were to receive in the good or service, but the price relative to that had an emotional impact.

What gives us value, makes us happy. Whether it is as simple as buying a can of soda - the cost of a can, say a dollar - gives us some happiness. We can accept the dollar cost as decent value. We are familiar with the cost and the experience of the soda.

However, when someone tries to sell to us the same can for $3, we can say it is a lower value proposition The amount of happiness it gives is the same - but the price is higher. - i.e. it gives a lower happiness to cost ratio.

In the same way, we can consider the LCOE of a project a representation of the design, and later, the operations phase - availability, reliability, maintenance cost, as a ‘feasibility indicator’.

It also offers the chance to look at the cost of energy with a constant basis across time. This is important for benchmarking asset performance against itself over time because inflation, and other cost items, cost of financing, labor, repair materials, energy etc. can distort the year-on-year performance.

Because the LCOE shows the expected cost of energy going into the future, it can show multi-year trend of performance of the asset. For a utility, this metric can be used, at an asset level, to identify areas for investment, significant re-work/ enhanced maintenance planning as asset performance diverges from expected cost per unit energy produced.

LCOE - Why does it matter?

Accordingly, if a generating asset LCOE rises above the ‘break-even’ limit, then the asset can start to be considered as too expensive, and non-feasible. This is because the cost of power generated is higher than the cost of power to be competitive in the marketplace. The risk to the utility or power market is that it is too expensive and that customers - commerical and retail, will shop elsewhere to other providers. This can reduce the revenue from this As a result, the asset can be flagged for work-over or retired and replaced with more efficient equipment which generates energy with a lower LCOE.

There have been some commentators who specifically look at LCOE as an indicator of obsolete assets using hydrocarbon fuels, accompanied by a significant bubble in their valuation. Part of the bubble, they assert, is that corporate financing is often used to build and maintain the energy generating asset. This is the case in both renewables and conventional power generation. However, with gas and coal, the cost of that power will be higher than renewables.

Tony Seba and the independent think-tank RethinkX believe that there is a trillion Dollar asset bubble blowing in conventional power generation asset, and adjacent asset valuations. The crux of their argument is that the official projections for LCOE which determine the strike price, the feasibility point, as mentioned earlier, are not aligned with reality.

The team point to the projections for LCOE for coal powered assets repeatedly falling short of reality. However, the group does not mention about gas power assets which have a lower LCOE.

As a result, the financing secured against the expected future value and power generation of the plant are inherently over-valued relative to probabilistic future generation. This means that even if the plants are generating at a point below the break-even limit, once decentralised energy generation ramps – RethinkX thinks that this wave is breaking already in certain areas. Sunnier states and parts of Europe are considered to be in such position.

This is in stark contrast to the comments of Total CEO Pouyanne who advised that gas and oil production must continue to enable financing of transition to renewable energy: “If you lose part of your source of cash and you are not able to finance your development, then you have an imbalance.” This comment directly addresses the commitment of oil and gas producers to continue to finance their transition.

Like their counterparts in the Automotive sector, energy majors and utilities may struggle, during periods of relatively depressed energy prices, to invest in renewable assets when they are committed to paying significant dividends to shareholders.

Consider - in simple terms:

An energy firm takes in $10 in revenue in Q1

$3 goes out to cover operating expenses

$2 to invest and develop the business a new direction (and also invest to maintain production from existing hydrocarbon assets)

This leaves $5 as the Operating Income (also read as Net Profit)

of which $3 goes out to cover dividend

The above example may seem contrived. Let's probe this and look at the Q1 earnings reports of some energy majors. We can see some comparable examples, highlighting the constraint of shareholder commitments on the energy transition.

First up, Total. For Q1 2021:

Cash flow from operations: EUR 5,59 B

Net Investment: EUR 3,96 B

Net Operating Income (Profit): EUR 3,48 B (0.91 EUR/ share)

Taking a conversion of USD:EUR 1.22

This makes Profit as USD 4,25 B (1.1 USD / share)

The dividend announcement Q1 2021 advised of a EUR 0.66 / share (0.88 USD / share) return to shareholders.

The investment cost was this was likely focused on reinvestment in plant and upstream assets. This is necessary to maintain production from existing assets at the same rate, or to help stem a falling production rate.

For Total, they took a 23% stake in a 640 MW offshore wind project in Taiwan. From the article, the PPA agreement cost was determined at $250 / MWh for the first 10 years, lowering to $125 / MWh for the following 10 years. The overall cost of the offshore asset was reported in the as NT$ 94 B. This makes the complete project cost (including seabed acquisition, design and construction together) a little over $3.3 B, with Total's stake of that coming in at $ 775 MM.

If we consider the total cost of the project against the capacity:

$ 3,000,000,000 / 640,000 kW = 4687 $ / kW capacity.

If we compare this to the complaint of Pouyanne that the prices being paid for new renewable projects is inflationary and not value-conscious, then this somewhat contradicts his point. I illustrate this point below.

How Inflated are Seabed Lease Costs?

Most of the European/ American projects Pouyanne referred to were gained at significant and increasing cost at the seabed auction. Case in point - the Irish Sea blocks which came up at the Crown Estate 4th Round of seabed lease bidding.

Let us look at the highest seabed cost / capacity project on the chart from the Financial Times above - that of ENBW & BP. In Feb 2021, this consortium successfully won the latest round of UK seabed auctions. Greentechmedia asserts in line with the Crown Estate report that the seabed leased in this deal can support 3 GW of offshore wind generation from 2 blocks sitting adjacent to each other, in 35 - 40 m of water, at a distance of about 30 km offshore.

The consortium bid £154,000 / MW, more than double the competition to successfully win the blocks. This works out to $ 212,000 / MW of generating capacity (using USD:GBP conversion of 1.38 from above).

We can multiply up to determine the total outlay for sea-bed lease:

$212,000 / MW x 3,000 MW = $ 636 MM

Remember the joint venture has paid for 2 blocks at the same rate, giving a total of

$1.27 B.

In another report, it is shared that the consortium will pay out £231 MM / year on the 2 blocks making a total of £924 MM ($ 1.27 B). This is in agreement with the initial report from the Maritime Executive of $1.2 B payout to secure the blocks. This marks the option period as the consortium reaches to Final Investment Decision in 2025. This gives us greater visibility of the cost structure of the lease and how the winning bid will be paid over to the Crown Estate.

Cost of Seabed lease: $1.27 B.

Let us look at the cost of installing 8 GW of offshore capacity in this context.

Cost of turbines - With wind power, bigger is better. The larger the rotors, the more energy can be gained per turn of the turbine. It also helps minimise the cost of the project - fewer units, installation hours - fewer piling or installation operations and maintenance - fewer visits to the wind farm, if the power generation is condensed into as few units as possible.

Given the similarity between the locations and potential mountings The turbines used in the dogger bank wind farm are the largest in the world at the time of writing. With blades of length 107 m and a total height above water of 260 m, each turbine can generate approximately 12 - 14 MW of power (according to the GE Haliade brochure).

If we take this assumption, we can approximate the number of turbines required.

Total field capacity 3GW = 3,000,000 kW

Capacity per turbine (assume 14 MW highest possible capacity for efficiency of capital deployment)

Cost per turbine - Estimated by Rystad Energy to be $ 3 - 4 MM. Let's take the high end because these units are a new product line and do not yet have the benefit of economy of scale to bring the cost down.

3,000,000 GW / 14,000 kW = 214 turbines

Cost of Turbines: 214 turbines x $ 4 MM = $ 856 MM

Cost of Installation - Given the relatively shallow depth of water, monopile foundations could likely be used for this project. As seen in this shot from a 'sister' project across the country at Dogger Bank - these GE turbines sit atop the yellow monopile, driven into the seabed. On top of this stable platform, the turbine is mounted.

The cost of monopiling - The Irish Sea concession sits in a similar depth of water to the Dogger bank concession on the opposite side of the UK.

There was some excellent research by University of Strathclyde (Glasgow - another city with deep sea-faring heritage) to bring together the data to calculate such numbers. For their work, they focused on 3 MW and 8 MW turbines. From their report, the cost of the structure was related to weight: A 3 MW turbine is smaller and lighter than an 8MW turbine, requiring more material.

For installation, the cost driver was the number of units, cost per turbine installed.

Charts from the Strathclyde analysis on costs for wind farm installation, by capacity. Credit: University of Strathclyde (Authors not mentioned in report).

However, there is also an effect of rationalising the cost due to the reduced intra-field electrical infrastructure. Fewer turbines means fewer connections to the substation, and so fewer excavations and cable laying operations to connect them. This also reduces the amount of sea-crew time and support vessel requirement.

Let us estimate for a 14 MW turbine:

3 MW turbine contributes 39% of the total installation cost, and for 8 MW turbine, 43%.

Scaling up from 3 to 8 = 5 MW difference, 4% increase in cost contribution. This calculates to 0.8% / MW increase.

From 8 to 14 = 6 MW difference. Rising another 4.8% from 43% to 47.8%. Round number 48%.

As established above, the project cost is proportional to the turbines cost.

Turbine cost = 48% of total installation cost

Turbine purchase cost = $ 4 MM each = $ 856 MM total

We can, for sake of brevity, use the same logic as proposed by the Strathclyde study and back calculate the rest of the project cost, using 48% known contribution from the turbines.

$ 856 MM / 0.48 = $1,783 MM = $ 1.73 B.

Total cost of Construction Project (including Management, Equipment and Installation)

The total cost of installation of the Irish Sea EnBW/BP equipment could be $1.78 billion dollars for 3 GW of capacity, if following a similar construction of Dogger Bank. I think this is a reasonable assumption, owing to:

- the economy of scale, rationalised infrastructure argument for fewer large wind turbines

- the trend toward constructing farms with larger turbines to capture more energy even in low wind

- the similar construction context - approx. 35 - 40 m of water, 30 km offshore

If we add this to the cost seen above for the seabed lease agreement, we arrive at:

$1.27 B + $ 1.73 B = $ 3 B, for 3GW of capacity.

This makes for $ 1 B per GW of capacity. This serves as a benchmark for other world class wind projects. This can help us determine if a project is better or worse value on a cost per GW generation capacity.

Sensitivity

For the purposes of uncertainty in assumptions and calculation error, we can consider a 50% or a 100% cost increase on the cost estimate for the construction project. The seabed lease is a well defined cost. This gives us $ 2.59 B, and $ 3.46 B of cost for the field development, resulting in estimated total asset cost of: $ 3.86 B and $ 4.73 B.

Benchmarking the Value of New Generation

Let us compare back to the Taiwan project of Total. In that project, the Yunlin OWP consortium had paid NT$ 94 B ($ 3.37 B USD) to construct a 640 MW offshore wind farm. Note that the construction had happened before Total stepped in, and we await commissioning by the end of 2021. In this sense, we can consider the projects are of the same generation as the Irish Sea asset, and estimated to be completed within a few years of each other.

This gives an overall run-rate for the Yunlin OWP project of :

$ 3.37 B / 0.64 GW = $ 5.26 / GW of capacity.

This cost is 5 x higher on a $ / GW basis than the estimate made for the Irish Sea asset. Taken another way, even if our assumptions or calculations are grossly incorrect we can compare using the sensitivity costs for the installation and construction on the Irish Sea project. Here we can say even for 50% higher, we can still say that the whole 3GW asset would cost $ 4.73 B - a run rate of $ 1.57 B / GW. This cost is still less than 1/3 of the cost / GW rate that Total paid.

In this sense, we can challenge Pouyanne's outward statement about avoiding pricey opportunities, yet Total stepping in to get a minority stake in an asset far more costly (from a cost per GW perspective) than a similar one in Europe. Ultimately, the cost of the developed project goes over and above the LCOE for other projects. Seen in this light, Total took an expensive move by landing the Taiwan project stake.

However, to their credit, Total now has a foothold in the Taiwan/ Asian wind power generation market. By leveraging their venture partners, this could open up further collaboration opportunities to bolster their balance sheet with profitable renewable assets over the next decade.

What does this mean for LCOE?

When we see claims of such high 'premium' paid to gain access to renewables projects, we can review and make calculations such as above.

There is the matter of the magnitude of investment as well. Total paid $ 775 MM for their stake. BP and their partner EnBW will likely pay close to $ 4 B total to realise their investment as an operating asset. It could be a case that Total simply didn't have the budget for this scale of investment in renewables.

To wit, In their 2020 20-F filing Total advised that the group had secured $ 2 B in 2020 for renewables investment. In this light, the 23% stake in Yunlin OWP took 40% of that straight away, leaving little left for the magnitude of investment required for such a prospect as Irish Sea.

Here we more clearly illustrate the double-bind of energy incumbents. If these companies, considered as value stocks, did anything to apprehend, modify their outgoings to facilitate a higher rate of renewables portfolio transfer, through cutting dividends, they could see a plummet in their stock price as shareholders move to larger, and resulting lower shareholder support. Indeed this happened during the Covid-19 pandemic to some companies, including Shell, as majors which took this action.

This is a similar concept situation experienced by renters in major cities - the dilemma of wanting to own a home, but because of the rents in front of them, cannot save enough for a downpayment to pay to transition to a more sustainable long-term position.

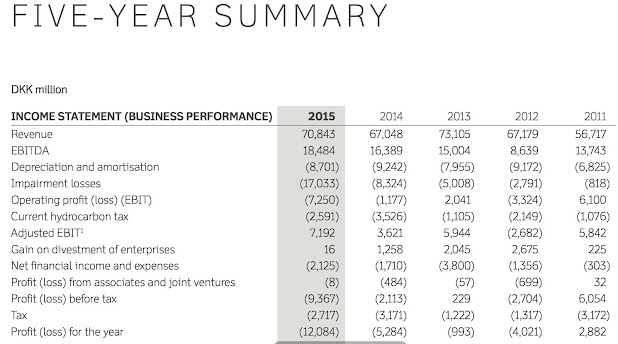

But how to walk out of this scenario as an energy company? How to make available the necessary capital to invest in new projects, much less those with lower payout than an optimised hydrocarbon play. Competitors such as Orsted and Vestas also pay a dividend, and a handsome one too. Orsted financial statement 2015 advised that dividend guidance was no less than 40%, no greater than 60% net profit. However, profits for Orsted (previously DONG Energy) during the middle of 2010s became increasingly and significantly negative owing to the huge investment to become a European leader in renewables - specifically European Offshore Wind.

The 2011 net profit was instructive of the level of remuneration when Orsted had a hydrocarbon portfolio: 2.5 B Krone (5 Krone / share).

At 2011 USD:Krone FOREX rate of 5.35, net profit comes to :

$ 13.37 B (approx $25 / share dividend)

During this time 2011 - 2015, it is worth noting that Orsted's Operating Income became increasingly negative. This was in line with the oil price crash of 2014-16. This may have been a significant motivator to translate to a wholly renewables portfolio.

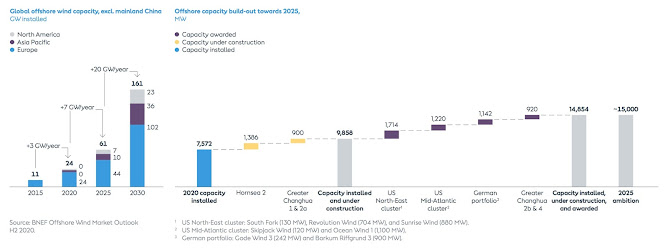

Comparing the company position now, we can see that it was a beneficial decision to translate across to a pure power player. This comes 5 years after their landmark announcement of the complete divestment of their hydrocarbon portfolio - announced in Q3 2016, completed in 2017.

Moreover, the Orsted 2020 Annual Report conveys a transparent and healthy looking mix of renewables projects. By taking the hit early, Orsted have come out strong in the energy transition, and directly treated the dilemma of divestment. This way, they have a strong, credible platform to grow their portfolio, having already embedded the external experience they need to move quickly and confidently.

Orsted Build-out plan 2020 - 2030. Here we can see a transparent commitment to what capacity will be added where. Remember, this plan does not only address the near term prospects which are ' in the bag' but it also speaks of confidence that they will find the opportunities toward the end of the decade as well. Credit: Orsted

A Round Circle

Having looked at the concern of LCOE, some claims from majors around the 'pricey' renewables as a threat to energy businesses, and also at a fore-runner which has made an early transition to renewables (relative to the rest of the field), we can say that we have tools to estimate how quick a company can move, what it can typically cost to make a move, what 'good' looks like, and what to expect when you get there.

You can reach me on Twitter @Ronnie_Writes

Comments

Post a Comment